Mortgage Loan calculator will calculate your loan amount against calculating the original amount of mortgage including insurance, taxes, interest rate and loan term. It is important for everyone to calculate the loan amount and understand that how much he has to pay until the end of the time period and the person will know about extra payments.

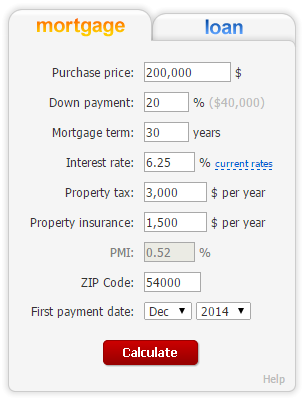

This mortgage loan calculator will calculate with taxes and insurance and you can use it as your loan payment calculator as well. This will take following amenities;

- Purchase price: What price you have paid when you have purchased your property.

- Down payment: What initial payment you can pay for getting loan.

- Mortgage term: Number of years in which you can pay back the amount.

- Interest rate: This is Annual interest rate and you will bind to pay this.

- Property tax: Mention here your annual property tax amount.

- Property insurance: You may have insured your home or building or your property, if not then before getting the loan you have to get its insurance first.

- PMI: This is private mortgage insurance.

- First payment date: Please mention the date when you will start to pay your first installment.

Mortgage Loan Payoff Calculator Usage

Loan payment calculator will let you to calculate the loan equity for your home, shop, business building or any other asset which you posses. Most important is that it will keep you away from the attorney who gets money from innocent people to calculate what they will get and how much they have to pay. In fact, this calculator is more useful for you that you will save lot of dollars.

It is important that most of the people try to pay off their mortgage within 10 years of time. Increasing from this slab will put you in difficulty. Now a day’s lenders have strict their rules to borrow money to mortgage lenders. Try to get less amount of money for you mortgage. Mortgage rates changes on day by day basis. So it is important to think and implement from the day one.