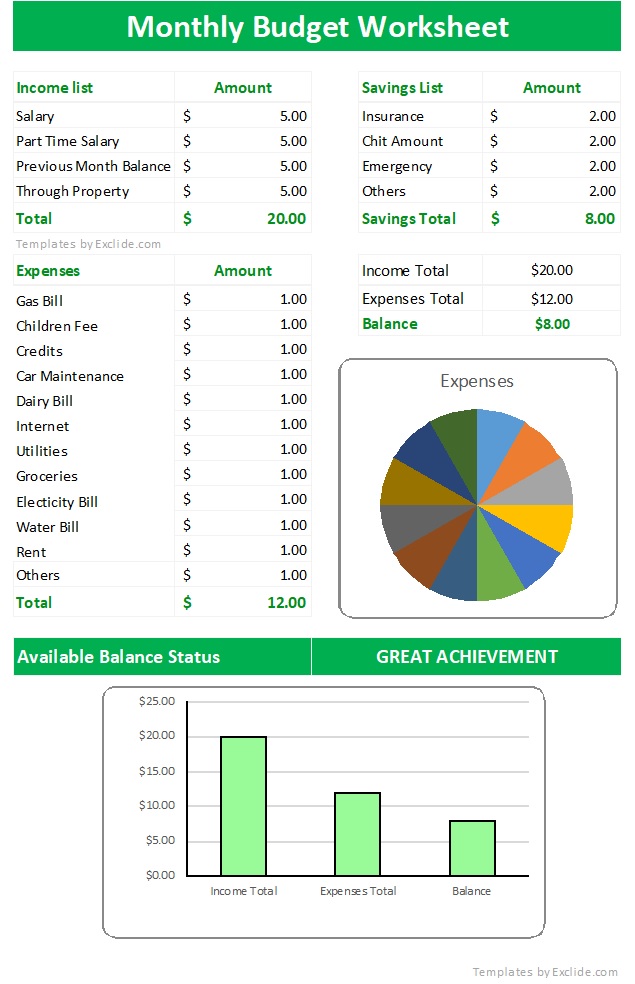

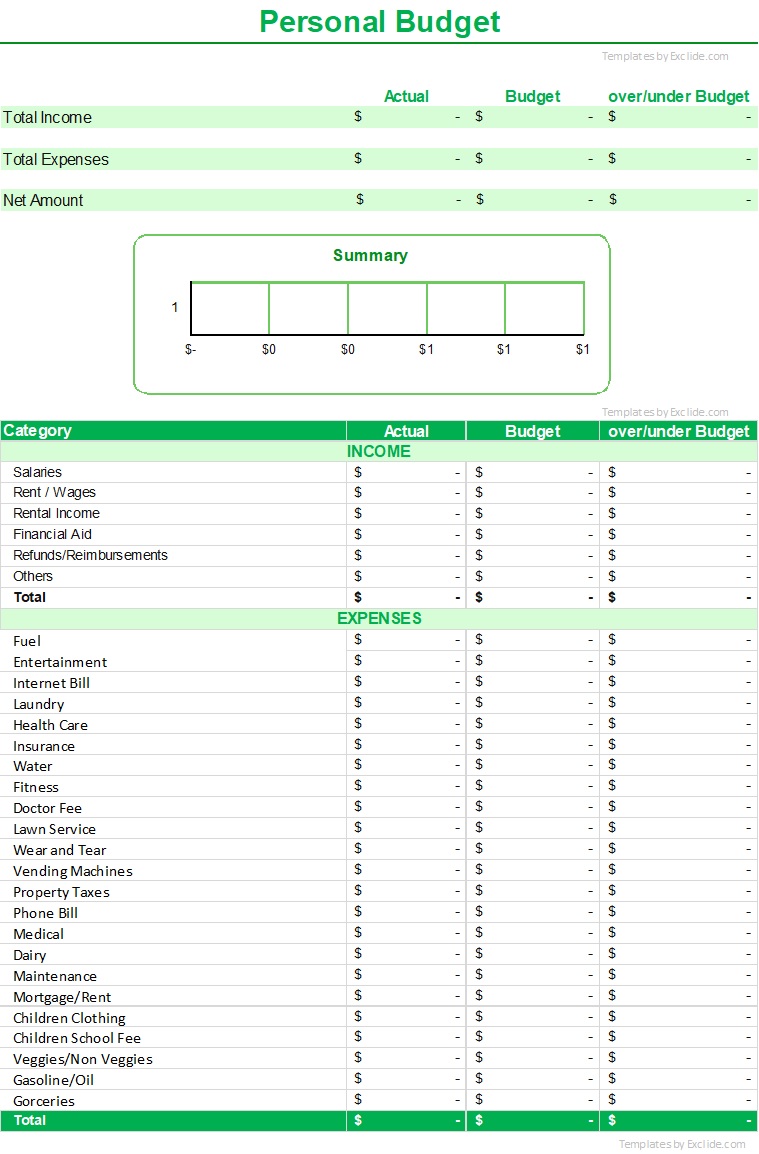

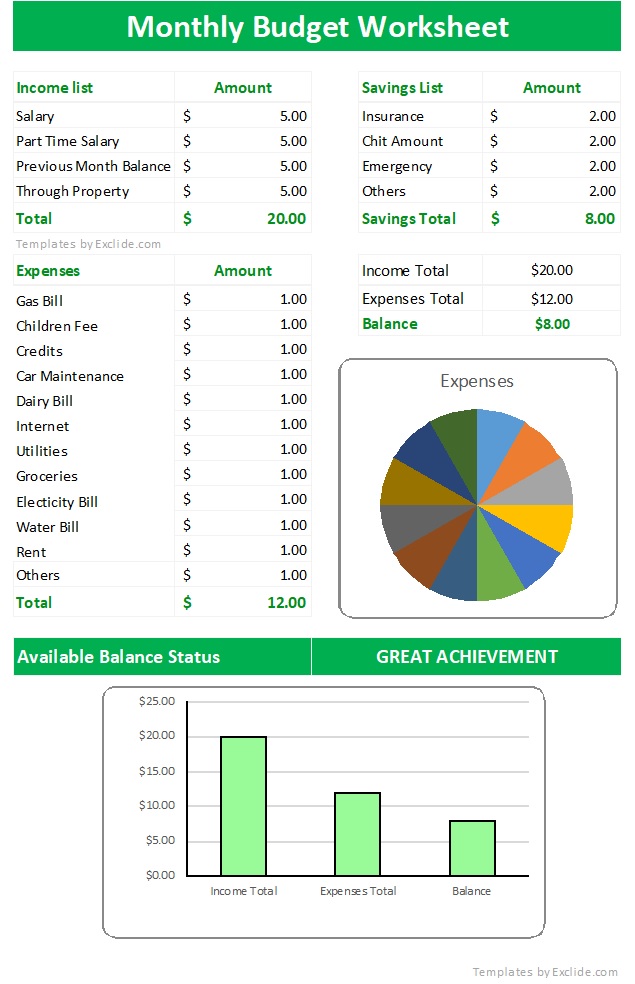

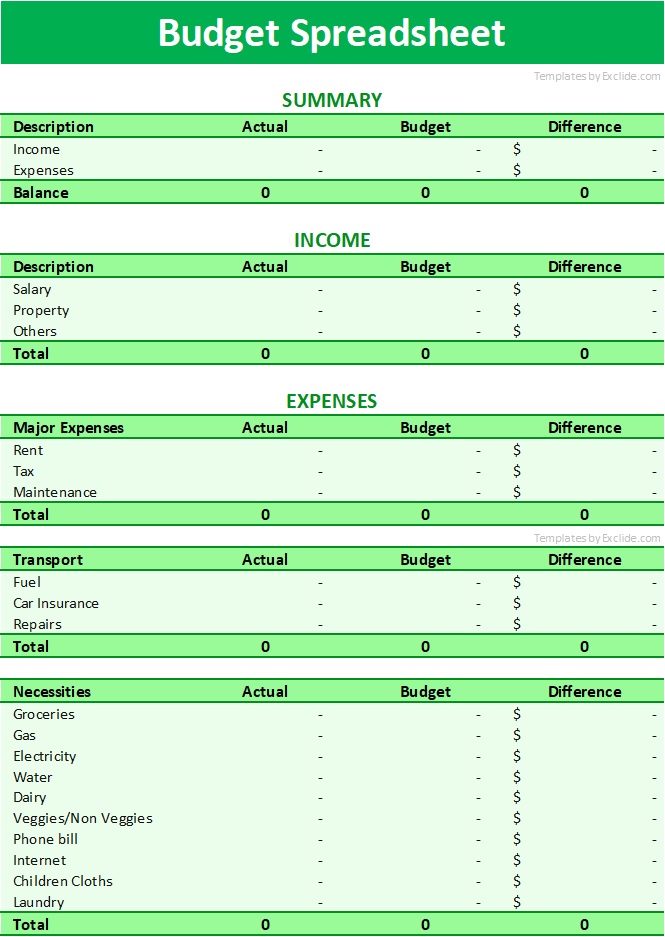

Budgeting is an essential component of any individual’s personal or professional life. Whether it directly deals with managing your personal utility bills or luxury expenditures, or it deals with the sort of investments you want to make in any professional business, excel budget template can help you keep taps on your expenditures and how to spread your expenditure over a particular time period.

Many online budget spreadsheet are available that can be used through Excel or Google Docs to get your expenses summed up for you. There are multiple types of budget template excel that are available with different features, for you to tweak a bit and adjust them for your personal use.

Why Use Excel Budget Templates

The in-built features of excel budget spreadsheet allow the user to be flexible with the way the user wants to organize the information and use it. Most of the neglected part of information for any user is the daily expense on small things that otherwise go unnoticed as compared to expensive personal shopping or investments. Excel template for budget helps you keep track of your day-to-day expenses so that you can estimate your complete expenditure more accurately.

Moreover, in excel budget spreadsheet, you can keep a track of your financial commitments and investments alongside your personal expenditure and calculate their monthly averages to analyze your expenditure as compared to the annual income.

This can allow you to keep a better record of your loans and debts when compared to your investments and expenditures. Furthermore, in this way you can direct your income towards repaying of loans and filling in for day-to-day expenses without becoming bankrupted.

Moving on, excel budget template allows for annotation of each numerical figure which can help you keep a record of special notes with all the expenditures. For example, if you made a unique expenditure on some Christmas gift that you normally wouldn’t have, you can highlight it as an additional cost and it can be conveniently ignored in calculating your monthly average.

Therefore, yearly budget template makes it more convenient for you to keep a record of your expenditure and gives you rationale based on numerical date for your future financial commitment. This sort of rationale helps you stay on budget and increase your savings over the years and make sure you never land in difficult financial crisis.

In cases you might end up in great amounts of loans, it can help you sort the repayment issues out over a period of particular months or years and how should you make use of your annual or monthly income to repay the loans effectively within the deadline.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.